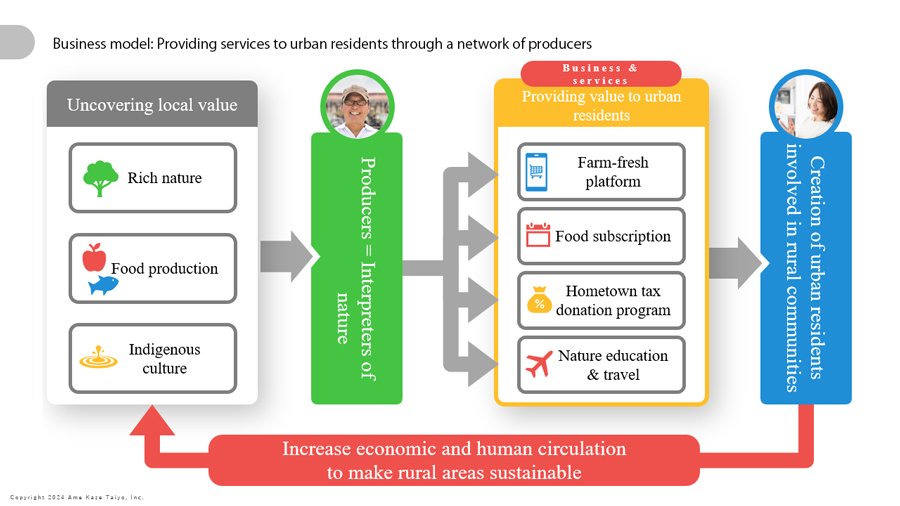

On December 18, 2023, Ame Kaze Taiyo, Inc. based in Hanamaki City, Iwate Prefecture, was listed on the Tokyo Stock Exchange (TSE) Growth market. This startup, operator of the “Pocket Marche” farm-fresh platform, originated from Tohoku Kaikon, an NPO established in 2013 in the aftermath of the 2011 Great East Japan Earthquake, which launched “Tohoku Taberu Times,” the world’s first magazine accompanied by locally sourced food.

Many of the earthquake victims were producers engaged in agriculture and fishing whose production systems and sales channels were severely disrupted or destroyed. Amid this devastation, Mr. Hiroyuki Takahashi, now CEO of Ame Kaze Taiyo, seeing a need for media that could reconnect producers and consumers for regional reconstruction, launched a magazine focused on highlighting local producers and providing useful information for consumers. In 2014, he established the Japan Taberu Times League, a general incorporated association, and rolled out the “Tohoku Taberu Times” model in 50 regions across Japan and Taiwan. This initiative paved the way for the release of the smartphone app “Pocket Marché” in 2016. With the slogan “Blending Cities and Rural Areas,” Mr. Takahashi achieved the listing of Ame Kaze Taiyo to accelerate the nationwide rollout.

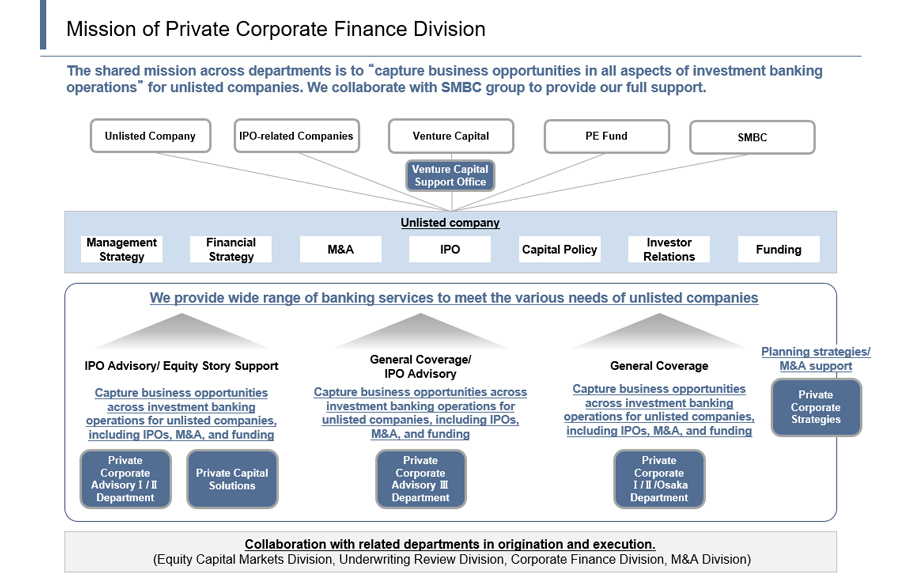

SMBC Nikko Securities served as the lead underwriter for Ame Kaze Taiyo’s initial public offering (IPO). In April 2023, the company reorganized previous units into the Private Corporate Finance Division to support overall investment banking operations for unlisted companies, providing advanced solutions, especially for startups, in collaboration with other divisions and group companies.

In a presentation during the competition to select the lead underwriter of the IPO, SMBC Nikko Securities stressed the importance of reaching out to investors to gain their understanding of Ame Kaze Taiyo’s “IPO to resolve social issues”. Furthermore, the presentation emphasized that the entire SMBC Group would support the IPO, a commitment that was highly appreciated by Ame Kaze Taiyo.

The three principal services the Private Corporate Finance Division offers are: 1) IPO support, 2) venture capital collaboration support, and 3) M&A support. SMBC Nikko Securities focuses on startups that have industry’s first or world’s first technologies, services, or business models. It has supported many companies in their IPOs by serving as an “IPO bookrunner,” the lead securities firm responsible for underwriting and managing the offering and sale of securities during an IPO.

SMBC Nikko Securities has led the industry as the top IPO bookrunner in terms of underwriting volume for four consecutive years, from 2020 to 2023 (Source: SMBC Nikko Securities). Recently, the firm has supported major companies, including KOKUSAI ELECTRIC, a semiconductor equipment manufacturer listed on the TSE Prime market in October 2023, as well as startups such as ispace, listed on the TSE Growth market in April 2023, which is promoting the emerging space industry. SMBC Nikko Securities aims to create world-class companies akin to the Magnificent Seven, a group of leading U.S. tech giants.

In terms of collaboration with venture capital, the Venture Capital Support Office within the Private Corporate Finance Division plays a pivotal role in fostering collaboration not only with SMBC Venture Capital, a group company, but also with various venture capital firms in Japan and overseas. The office organizes workshops, seminars, and business matching.

In M&A support, the Private Corporate Finance Division collaborates with the M&A Advisory Division to offer a wide range of solutions tailored to M&A.

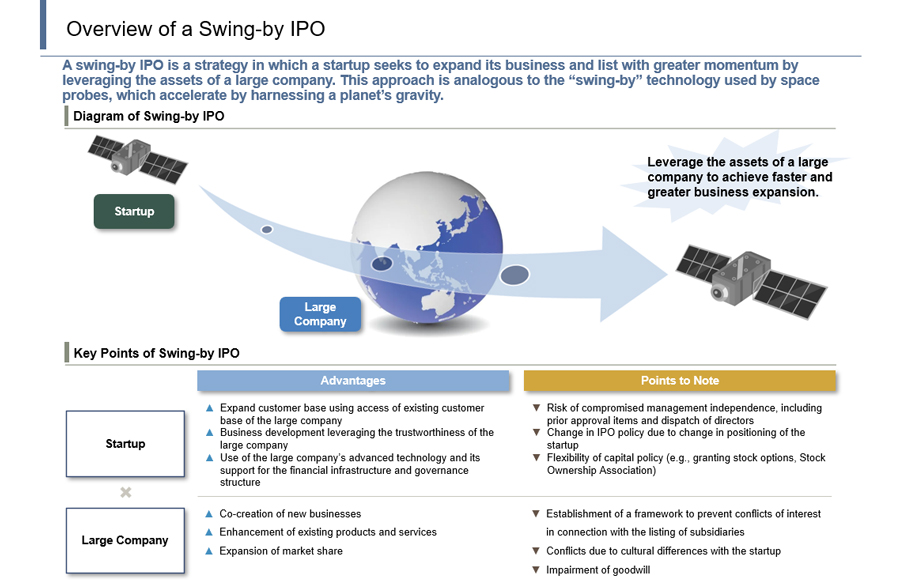

In recent years, SMBC Nikko Securities has also been emphasizing “swing-by IPOs.” This strategy involves a startup leveraging the assets of large companies to facilitate business expansion and achieve public listing. The term “swing-by” is inspired by the way space probes use the gravity of a planet to accelerate. Through this approach, a startup can take advantage of the large company’s existing customers, creditworthiness, and advanced technology to drive growth, while the large company can benefit from co-creating new businesses and enhancing the functionality of its existing products and services.

In supporting startups, SMBC Nikko Securities is placing particular emphasis on “impact IPOs”, which are attracting attention worldwide. This approach aims to connect companies that significantly contribute to solving social issues through their technologies and services with investors who are eager to address these challenges. From the investor’s perspective, this is known as “impact investing.” Ame Kaze Taiyo, mentioned at the beginning of this article, is attracting attention as an exemplary impact IPO, being the first company originating from an NPO to go public in Japan.

Internationally, the Impact IPO Working Group of GSG Impact JAPAN (formerly The Japan National Advisory Board, The Global Steering Group for Impact Investment, known as GSG Japan NAB), under the umbrella of UK-headquartered GSG Impact, which promotes impact investing, in May 2024 released “Guidance on Impact Companies on Disclosure and Engagement in Capital Markets Version 1.” As a member of this working group, SMBC Nikko Securities is actively promoting impact IPOs.

Empower startups resolving social issues to grow through impact IPOs and cultivate world-class companies— SMBC Nikko Securities’ mission.

EN

EN

Journalist Junichiro Hori on Sumitomo’s DNA

Journalist Junichiro Hori on Sumitomo’s DNA